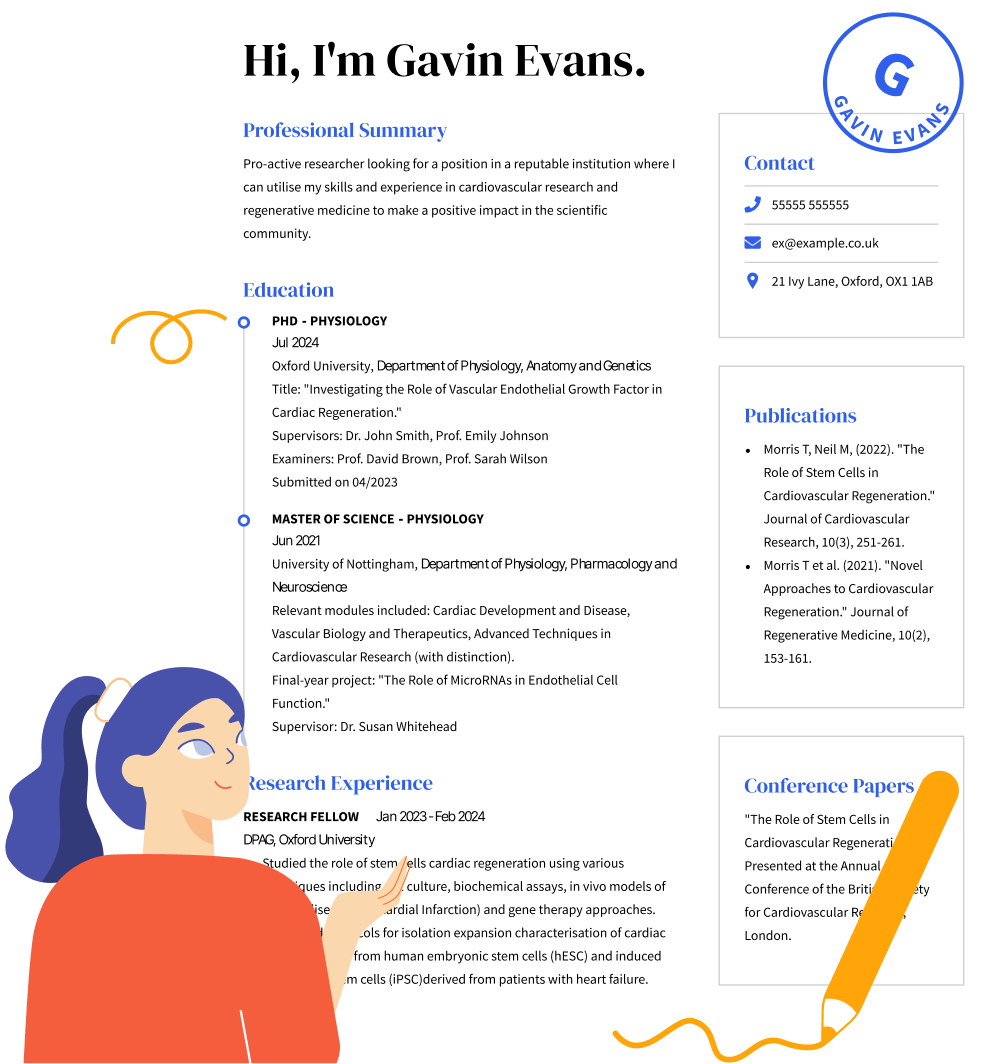

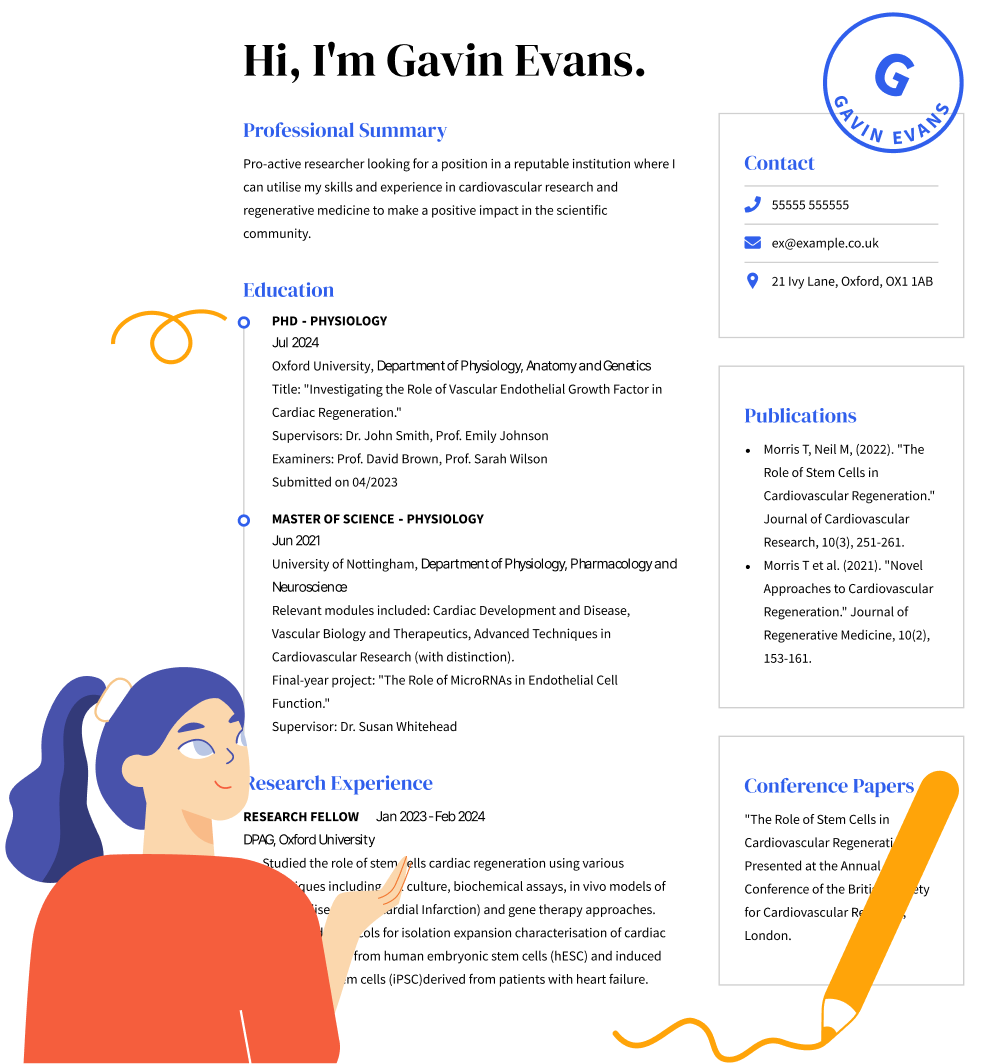

Your private equity CV structure will usually depend on the

CV format.

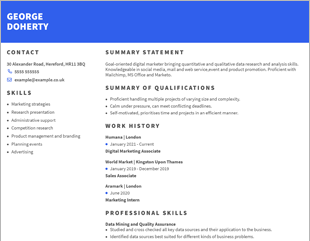

You can choose a chronological or combination CV format that shows off your employment history and skills.

Job seekers with ample experience choose a chronological format that will highlight work experience, beginning with the most recent job first. If you lack experience or you don’t have any experience as a private equity analyst or investment banker, then you can choose a functional CV to show off your skills.

Regardless of the CV format you choose, your CV will probably have similar sections such as: *

- CV summary

- Skills

- Work history

- Education

Header

Your CV header presents your contact details, allowing the hiring manager to contact you with important updates about your application. In this section, include:

- Your name

- Location

- Email address

- Phone number

If you have lots of industry experience but not enough room on your CV, then you can include a link to professional networking sites. Sites like LinkedIn are great ways to give the hiring manager or recruiter more information about your experience and skills.

CV summary or objective

Your

CV summary or objective is a short paragraph at the top of your CV that is your chance to grab the hiring manager’s attention. This section should include information that might encourage the recruiter to continue reading or invite you to an interview. A CV summary is usually two to three sentences and highlights your key skills, experience, and qualifications that will make you the ideal candidate for the role. If you don’t have a lot of experience, then you can include a

CV objective that outlines your career goals and intentions. This is a great chance to talk about why you’re interested in investment opportunities and what your future career goals are.

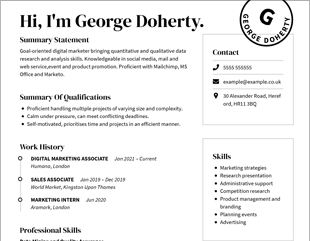

Skills

Equity associates need many skills to understand formulas and the investment market. The best CVs will have a good combination of hard and soft skills. Hard skills are role-specific and soft skills are transferable across multiple industries. Soft skills are your personality attributes and character traits.

If you don’t have any experience in private equity roles, then your

CV skills section will be very important.

When thinking about the correct terms that sum up your industry knowledge, consider these hard skills to create the perfect CV:

- Financial analysis

- Financial modeling

- Mergers and acquisitions

- Quantitative research

- Restructuring

- Knowledge of financial services

- Research for an investment thesis

- Understanding of hedge funds

- Microsoft Office (Word, Excel, PowerPoint)

- Real estate and asset valuation

- Management consulting

- Market research

- EBITDA formula

- DCF formula

- Collaborating with senior management

- Calculating ratios

Work history

Private equity associates usually need work experience with portfolio companies to work in a private equity role.

You should list your experience in reverse chronological order, starting from the most recent experience. This gives the hiring manager or recruiter the most up-to-date information.

You should list your duties in bullet point format under each job title. You should also include the firm’s name, location and the date you started and finished.

You should also include your key accomplishments if you have previously worked for PE firms. This can include metrics from deal experiences to show that your work has positive impact on clients.

To help you format this section, consider using a CV sample or CV builder.

Education

Your education section is an important part of your CV and shows that you have the relevant training to fulfill the job description. Private equity professionals will usually need a bachelor’s degree in finance and accounting, mathematics or a relevant field to show they can assess financial reports.

You should list your degree title and the year you obtained it.