How to write a great insurance agent CV

Looking for a new job as an insurance agent? Take the first step by learning how to write a tailored CV using industry-specific tips and templates.

Looking for a new job as an insurance agent? Take the first step by learning how to write a tailored CV using industry-specific tips and templates.

OUR USERS HAVE BEEN HIRED BY

Success as an insurance agent starts with the art of persuasion, and you’ll have to draw on those same skills when writing your CV for a job application in this industry. Your professional CV, along with your cover letter, is your chance to convince the hiring manager to offer you an interview.

This guide will show you:

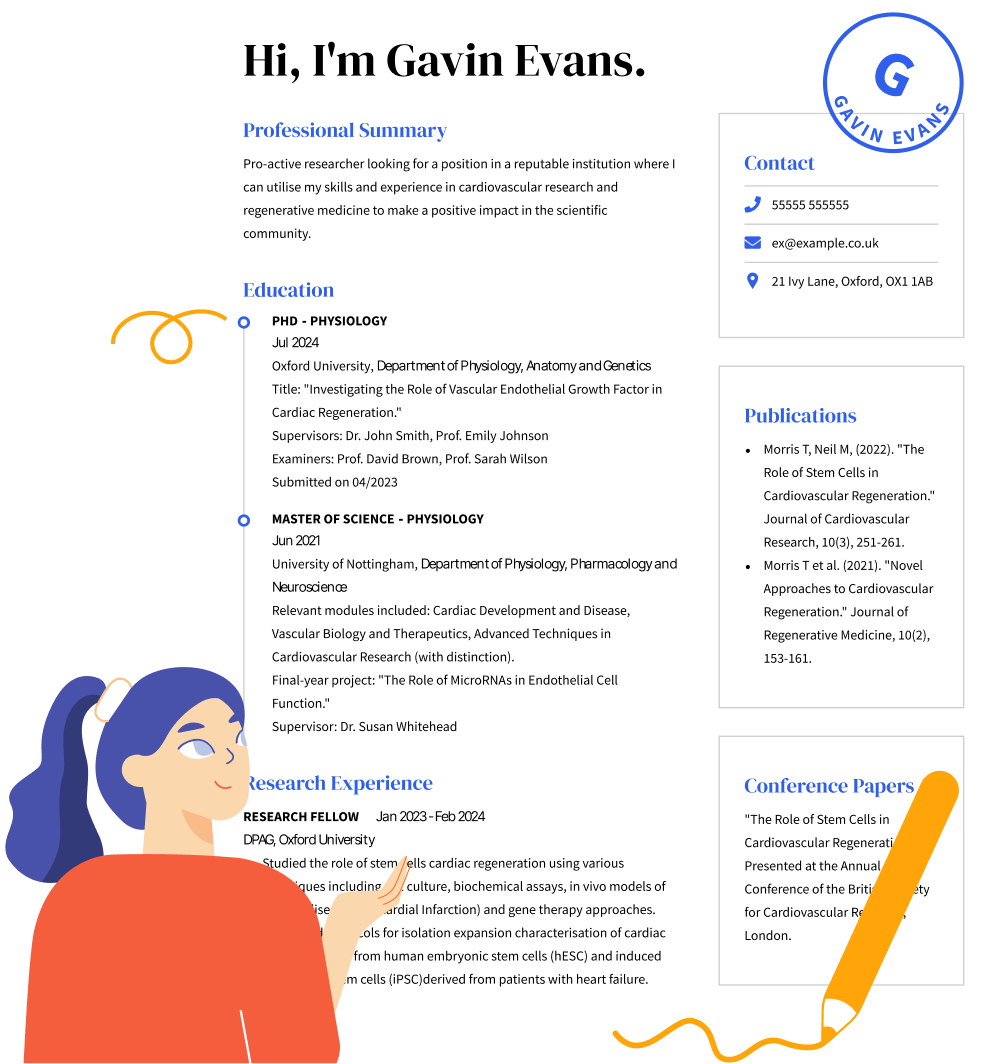

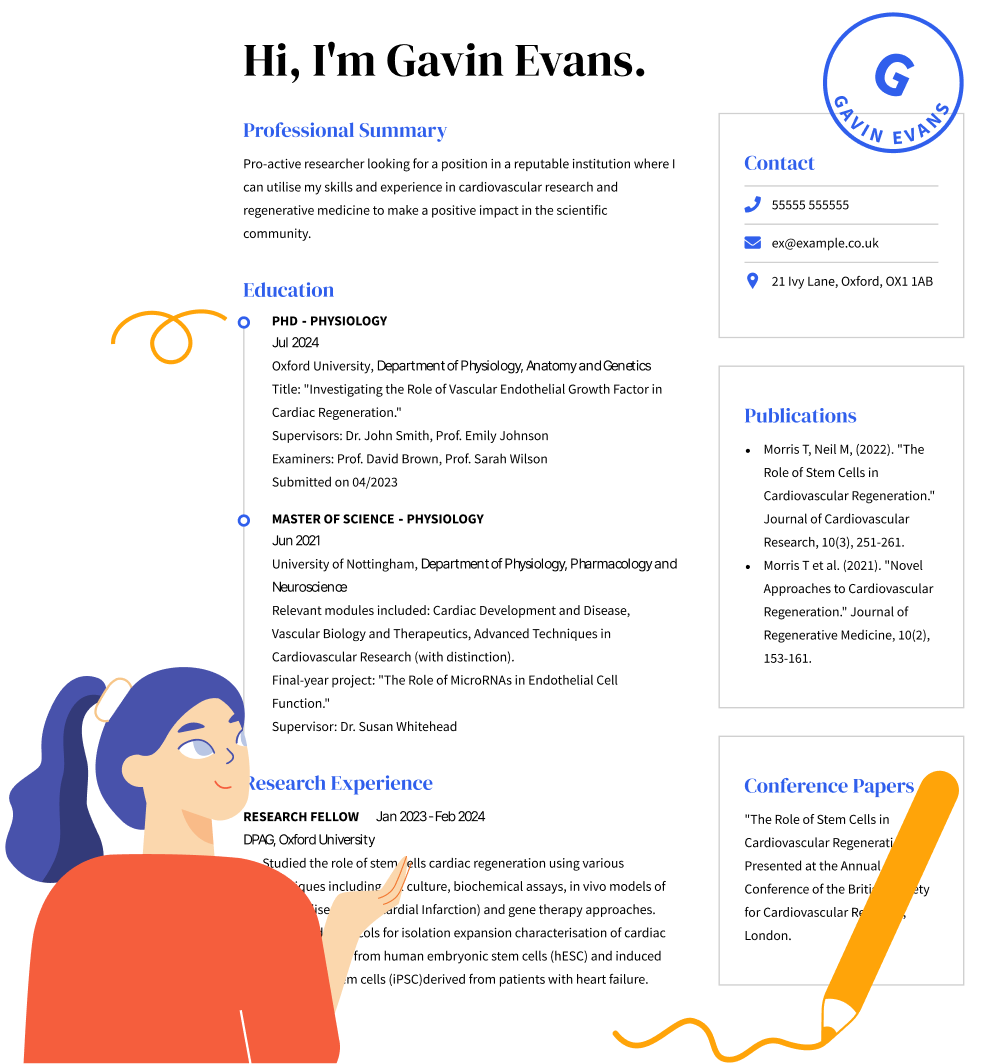

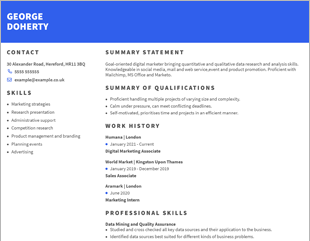

Your insurance agent CV should be well-presented, results-driven and will explore relevant experience in the insurance industry or a related field like sales.

Highlight any experience generating leads, nurturing client relationships, managing a client base, developing marketing strategies, and selling via inbound and outbound channels. If you’ve worked as an insurance agent before, then clarify where your expertise lies, such as with life insurance.

You’ll also want to showcase certain soft skills, such as communication, numeracy and customer service. Many of these skills are transferable and can be evidenced using sales experience from other fields like retail and hospitality.

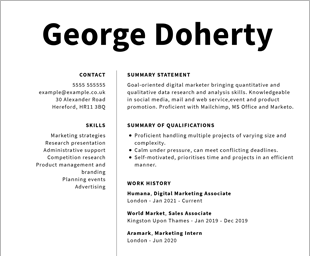

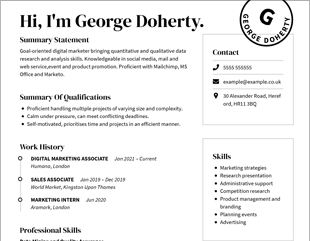

The structure of your insurance agent CV will vary depending on your chosen CV format. You have three options:

The chronological format is favoured by most recruiters and hiring managers. It’s also the format we use with the insurance agent CV sample below.

Add your contact details to the CV header at the top of the page. This information includes your

Present this information clearly so that the hiring manager can easily reach out to you should they wish to proceed with your application.

The professional summary or career objective is a brief overview of your skillset as a candidate. A professional summary covers your key skills and experiences. A career objective is similar but includes a statement of your career aspirations.

If you already have several years of experience as an insurance agent, then a professional summary will work best. Consider a career objective if you’re at the starting point of your career or making a career change.

Use the skills section to tailor your CV to the needs of the role. Study the job description and select some of the skills listed as essential or desirable to include in your CV.

Hard skills for insurance agent roles include:

Relevant soft skills include:

Aim to cover both soft and hard skills in your CV.

In the work history section, run through relevant work experience from your previous ten years of employment. This could include work as an insurance agent, general experience in a sales position or a former job in a call centre.

For each position, list the tasks and skills most transferable to the role of an insurance agent in bullet points. Where possible, use specific examples and statistics to add context and credibility to your work history.

List your highest level of educational qualification in the education section. This could be a diploma, bachelor’s degree or higher. You can also add relevant certifications, awards, honours, etc. to this section.

Insurance companies serve different markets. Make sure your CV is fit for purpose by showing your knowledge of the employer’s particular area of expertise, whether that’s auto insurance, homeowner’s insurance, life insurance or health insurance.

An ability to consistently hit targets is what hiring managers are looking for. Showcase your skills by referencing specific sales goals and client retention rates when discussing your work experience.

A CV template will provide you with a striking layout that’s sure to catch the hiring manager’s attention. Our CV builder tool features hundreds of free-to-use templates.

In such a results-driven profession, you may be tempted to exaggerate some of your past achievements or knowledge of insurance policies. This is never a good idea and it will cost you later in the process.

Unless your grades in college or university were exceptionally high, there’s no reason to include it on your CV. Doing so can actually harm your chances of getting a callback.

Yes. Writing a cover letter is an important part of your insurance sales agent job search. Always include a cover letter as part of your application unless the job posting says otherwise. Use the cover letter to expand on your key skills and explain any gaps on your CV.

You can still write a great CV without previous experience as an insurance agent. Any experience working in sales environments or call centres will be worthy of discussion. You can also focus on your experience as a volunteer or intern.

It’s important to adapt your CV to each new position you apply to. Tailor your CV objective to the needs of the role and organisational goals of the employer. You should also reshuffle the skills section of your CV to include some of the essential and desirable skills listed in the job description.

We personalize your experience.

We use cookies in our website to ensure we give you the best experience, get to know our users and deliver better marketing. For this purpose, we may share the information collected with third parties. By clicking “Allow cookies” you give us your consent to use all cookies. If you prefer to manage your cookies click on the “Manage cookies” link below.