Financial advisor cv examples for success in finance

Capitalise on the surge in financial planning roles and showcase your financial skills. Prepare the perfect CV using these financial advisor CV templates.

Capitalise on the surge in financial planning roles and showcase your financial skills. Prepare the perfect CV using these financial advisor CV templates.

OUR USERS HAVE BEEN HIRED BY

If you are gifted with financial skills and seeking a new financial advisor position, don’t take unnecessary risks with your job application by not tailoring your CV to the role. Set the benchmark high when creating your CV and you will yield positive results.

Before a hiring manager views it, your CV goes through an applicant tracking system (ATS) that scans your document for particular keywords found in the job description. Reduce the risk of your CV not being scanned favourably by following these CV tips.

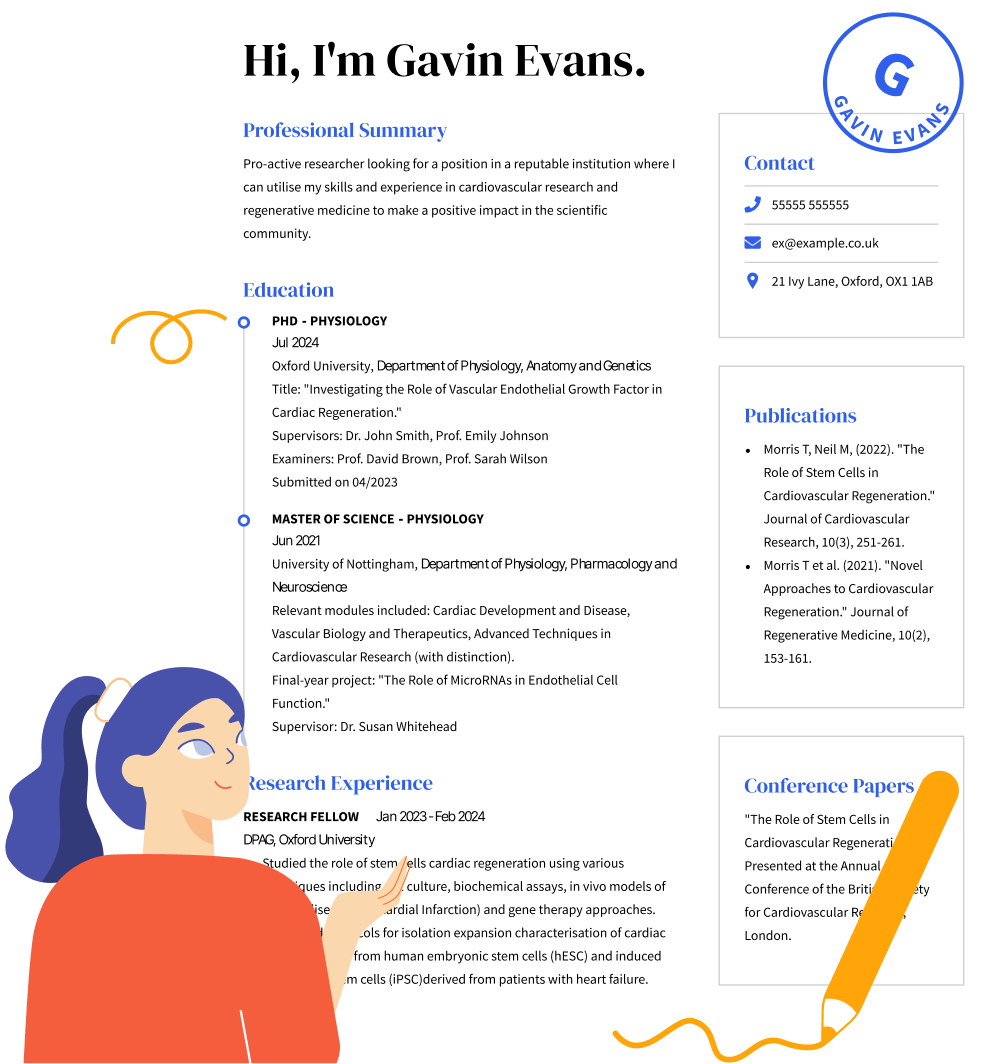

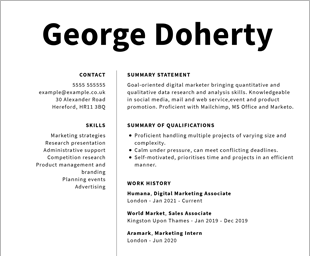

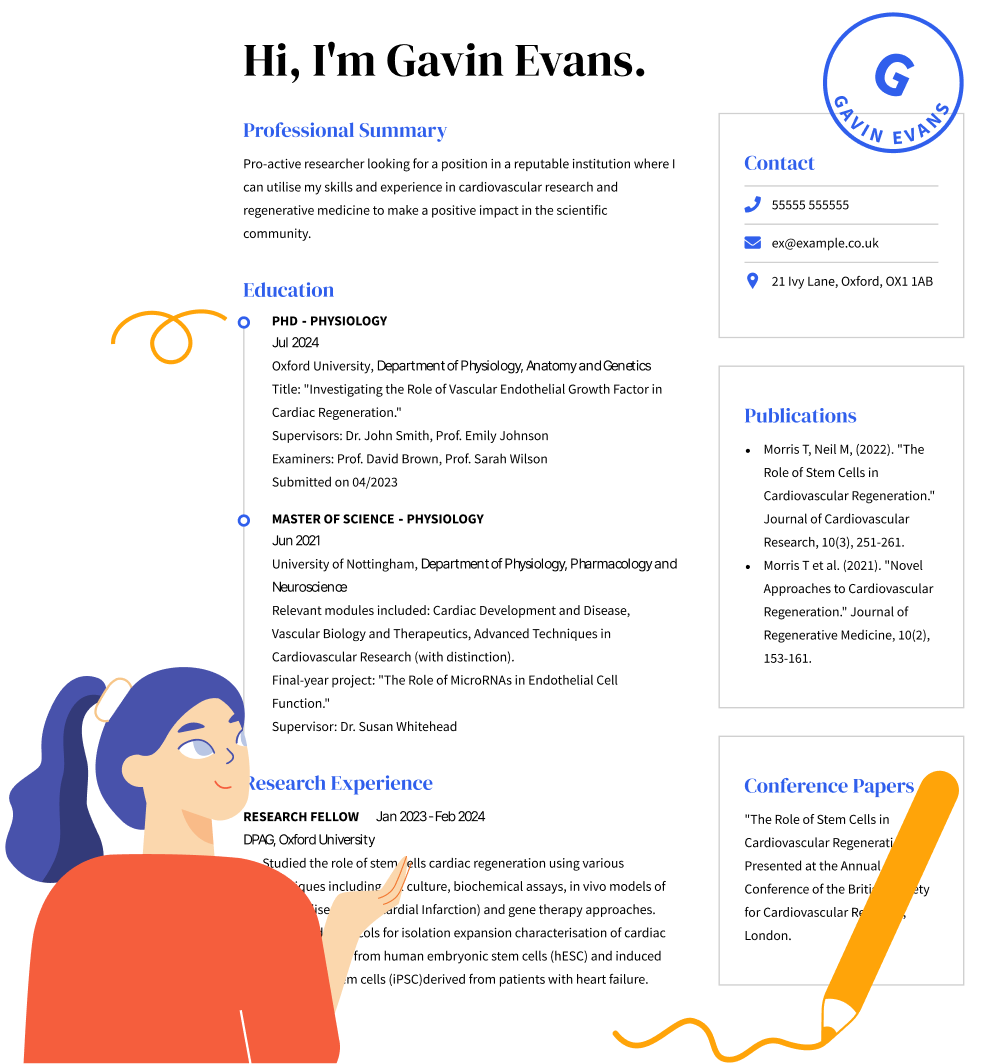

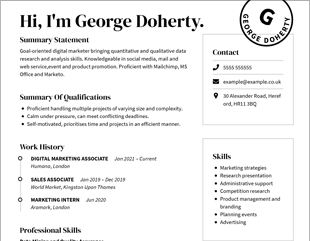

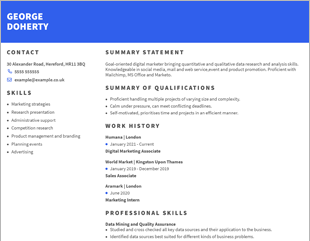

You will first need to consider the CV format for your financial advisor CV. If you have little work experience and want to exhibit your skills, use a functional CV format. However, if you have an extensive work history, you can use the chronological CV format. The combination CV format is a combination of both formats so it highlights both your skills and your work experience equally.

Regardless of the CV format you choose, you will still have the following sections in your financial advisor CV:

The header always contains your contact information, with your name, email address, telephone number and a link to your online work profile, such as LinkedIn. You can include your address, but a simple location will suffice. You don’t need to carry a photo in your header, as the general advice is not to have one for anti-discrimination and other reasons.

The next section is the professional summary or career objective. This is a short 2-3 sentence paragraph. In the professional summary, you will highlight your most notable achievements and years of experience. If you are a certified financial planner, be sure to mention that. You can also mention how you have increased profitability or ensured they met their financial goals. Alternatively, if you are fresh on the financial advice scene, you can explain your career goals in a career objective instead.

The best way to gain that financial advisor position is in the CV skills section. You can present your soft skills such as your organisational skills or attention to detail, and your hard skills such as estate planning or portfolio management experience. Bullet-point your skills for easy readability. Here are some skill examples you can use for ideas for your financial advisor CV:

In the work history section, list each of your jobs in reverse-chronological order, with your most recent job listed first. For each job, you will want to write 4-6 bullet points outlining your most significant achievements and skills. Also include the name of the company, your job title and employment dates. Only include the last 10 years of experience. If you have jobs that are older than that, you can include a full list of your jobs on your LinkedIn profile. Be sure to back up your statements with persuasive numerical data. Here are some examples you may want to consider for your financial advisor CV:

In the education section, you will want to include any degrees and certifications related to the job you are applying for. So if you have a bachelor’s degree in accounting or another financial field, be sure to list it. Any qualifications you have in other subjects may also be relevant, such as business administration or management.

Also, if you have a certified financial planner (CFP) certification or other related certifications, a recruiter will be interested in knowing about it. Additionally, any training seminars or workshops you have undertaken to further your education or for continuing professional development can be listed in this section.

For each degree and certification, be sure to include your year of graduation and the college you attended. In short, your qualifications should match up nicely with the job requirements. If you fall short, you can make up for this with your work experience or take on a more junior role while you complete the necessary qualifications.

Here are some tips for creating your financial advisor CV:

A financial advisor can work independently with their client base or work in an employed position for a company.

Financial advisors use their expertise to help businesses with their investments, tax commitments, strengths and weakness analysis, budgets and retirement plans. They can specialise in a particular area so that the job description might focus on hard skills in that category. For instance, a job description might request expertise in business expansion or how to increase performance.

You can start your CV and gear it towards financial advice using your education credentials. A bachelor’s degree in business, statistics, economics or finance would put you in good stead, and a master’s in business administration would only increase your employability. If your background is in marketing or sales, you could highlight this in your CV. Look for any internships in finance, as these will give you an excellent grounding in the industry. You can go for an entry-level position, assisting a financial advisor, while you gain experience or gain certifications.

Firstly, have a head for numbers. You must have a solid mathematical ability for this job and it helps if you enjoy working with numerical data. Other essential skills include interpersonal skills, critical thinking ability, analytical expertise, competence in sales and meticulous attention to detail. Use free CV templates to tailor your CV to get your next financial advisor job. And you can check out these cover letter samples for inspiration as well.

We personalize your experience.

We use cookies in our website to ensure we give you the best experience, get to know our users and deliver better marketing. For this purpose, we may share the information collected with third parties. By clicking “Allow cookies” you give us your consent to use all cookies. If you prefer to manage your cookies click on the “Manage cookies” link below.