Stunning debt collector CV examples for this year

Debt collection is a fast-paced job that requires excellent communication skills. Use these tips and examples to write a debt collector CV.

Debt collection is a fast-paced job that requires excellent communication skills. Use these tips and examples to write a debt collector CV.

OUR USERS HAVE BEEN HIRED BY

Debt collection requires making payment arrangements and settling outstanding debts while maintaining calm and respectful relations with debtors. This is why recruiters are looking for a specific kind of person.

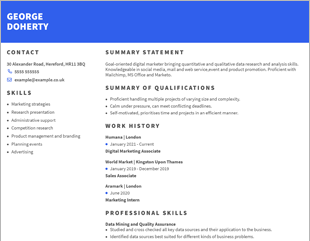

Work history

If you want to polish this basic CV structure, here are simple tips you should consider to stand out from the crowd.

DO

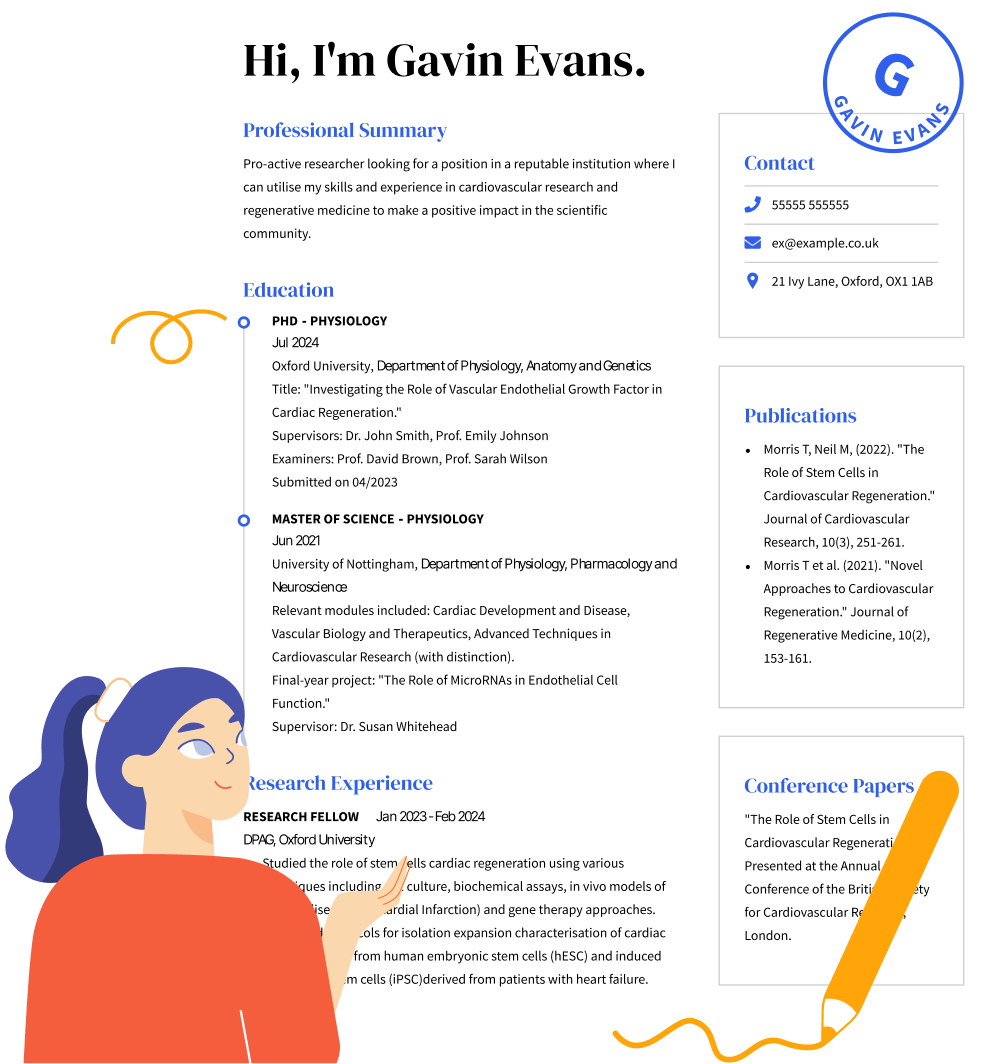

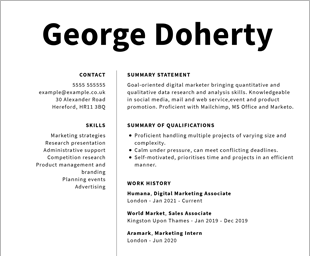

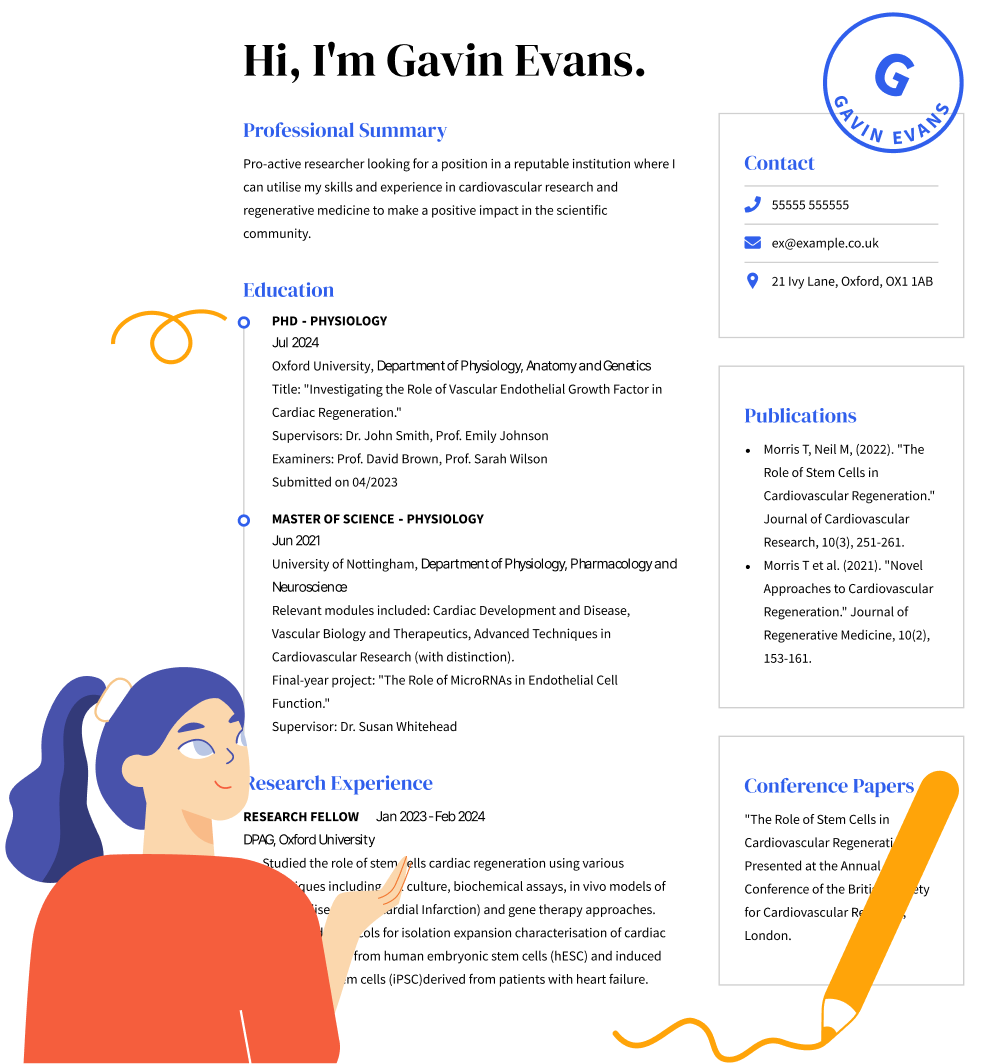

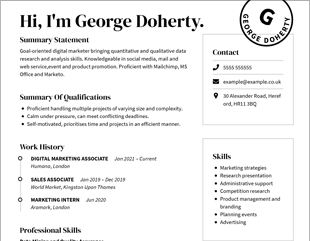

Reading appropriate CV examples before writing your CV can be very helpful. The right CV sample can show you just what qualifications, certifications, and skills are considered top-level in this industry.

If you have not worked in debt collection before but can port over transferable skills from other job experiences, emphasise them in your CV. For instance, if you have experience as a call centre dialer, you should list this, as the same skills used to communicate and resolve conflict when dialers make contact about past due accounts can be useful when collecting debts in person. Any customer service experience can be beneficial to a debt collector’s CV.

When you provide examples of your achievements, use specific metrics, such as percentages, to help hiring managers to understand exactly what you are trying to tell them. For example, say “Increased debtor repayment by 30% through a system of follow-up phone calls” rather than “I have a strong track record of successful debt collection.”

DON’T

While it can be helpful to use a case study in your CV to show recruiters how you approach collection efforts, it should go without saying that you should not name debtors. Instead, give a general idea of the case, the resolution and whether the debtor stuck to the agreed plan and paid on time.

The right debt collector CV template will impress hiring managers with a professional and clean-cut appearance, but the wrong template could go against you. Stay away from creative templates that go overboard on graphic design elements.

A CV should be a single-page snapshot of what makes you best for the job description you are applying for. Unless you’re applying for a job that demands an extensive work history section, stick to this single-page layout as it will make your CV more friendly for applicant tracking systems (ATS) and easier for recruiters to scan.

Yes. You should include a cover letter for every job application that you submit. If you want to make a really strong impression on a hiring manager, use a cover letter builder to match your cover letter and CV templates.

Debt collection is a challenging industry if you are young or have limited experience. This is because some debtors can be unpredictable and hard to manage. If you lack direct work experience in bill collection, focus on your experiences in related industries, such as security. If you have no such experience, focus on customer service experience with particular emphasis on conflict resolution.

If you have years of experience as a debt collector, you will have plenty of transferable skills in areas such as attention to detail and customer service. If you want to move into another industry, start by reading the job description you want to apply for, and highlight the areas in which your experience and skills overlap with the needs of the job posting. Then emphasize those experiences and skills in your CV.

We personalize your experience.

We use cookies in our website to ensure we give you the best experience, get to know our users and deliver better marketing. For this purpose, we may share the information collected with third parties. By clicking “Allow cookies” you give us your consent to use all cookies. If you prefer to manage your cookies click on the “Manage cookies” link below.