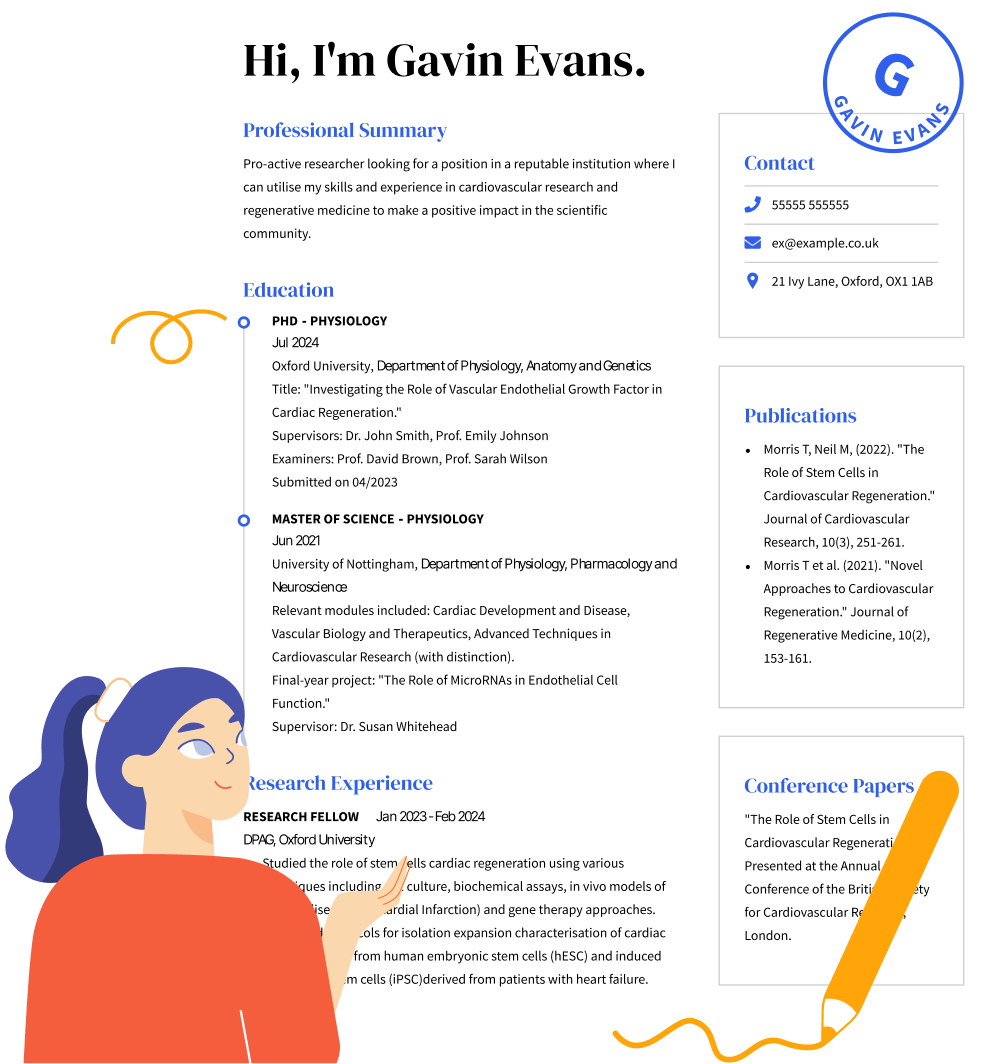

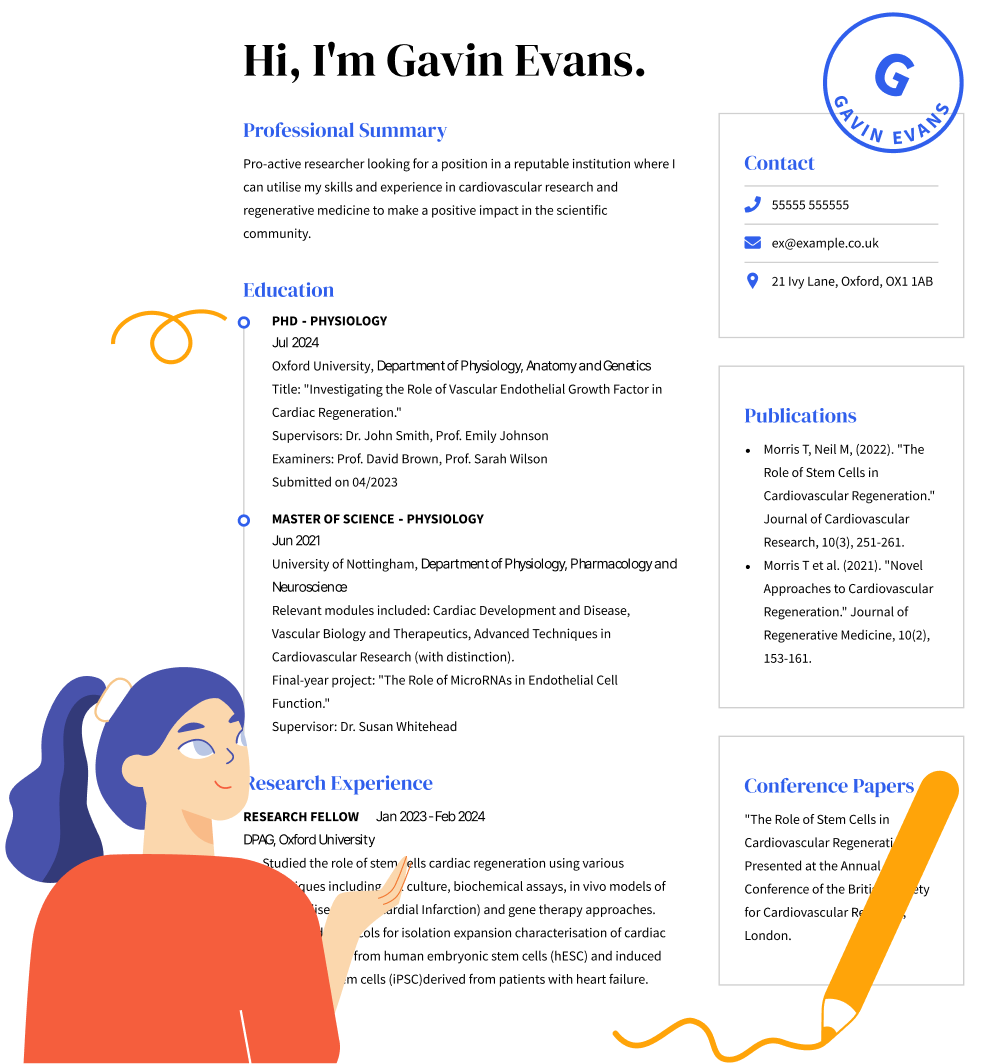

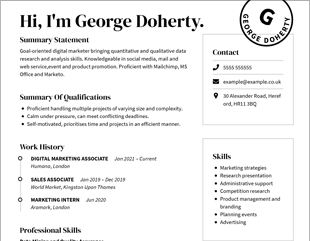

Actuary CV examples for this year

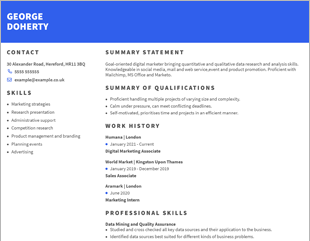

Secure your dream actuary role in 2024 with this CV example, and follow our tips for showcasing your best skills and experience to employers.

Secure your dream actuary role in 2024 with this CV example, and follow our tips for showcasing your best skills and experience to employers.

OUR USERS HAVE BEEN HIRED BY

Managing risk is a tricky role, so becoming an actuary requires a CV that shows you’ve got the skills to manage the position. To create the best actuary CV, you should highlight:

This article will teach you about the sections you need to include to showcase skills and experience to impress a hiring manager or recruiter.

The structure of your actuary CV will depend on the CV format you choose. There are three CV formats:

The CV header section contains your contact information. This helps hiring managers and recruiters contact you with updates about your application. In this section, you should include:

You can also include your professional social media links, like your LinkedIn profile. This is a great way to give the hiring manager more information about your risk management key accomplishments.

A professional summary is a short paragraph with two-to-three-sentences that summarise your skills and experience. This is an opportunity to hook the hiring manager with striking information that increases your chances of securing an interview. You can also include key skills that you think the employer will value. These can be skills you gained in a previous actuarial position, such as underwriting.

If you don’t have previous actuary experience and are applying for an entry-level role, you can use a career objective. A career objective is similar in length to a professional summary, but it instead focuses on your career intentions. You should explain why an actuary job aligns with your career goals and highlight any knowledge of actuarial valuation and related skills.

Depending on your CV format, your skills section may be the most dominant part of your CV. Even if you choose a chronological or combination format, you should include a mixture of hard skills and soft skills.

Hard skills, or technical skills, are specific to an actuary job and gained through training, such as statistical analysis. In contrast, soft skills are transferable, like interpersonal skills.

Here is a list of bullet points with skills you can consider adding to your CV:

Depending on the type of role and your CV format, your work experience section may be key. List your previous job titles in reverse-chronological order, starting from the most recent job. This provides the hiring manager or recruiter with the most up-to-date information.

You should then provide brief bullet points that summarise your previous duties. You should also include metrics from your professional experience that demonstrate your skills have tangible results.

Actuaries will need qualifications that support strong maths skills, actuarial science and statistics. Gaining a bachelor’s degree in maths and statistics, actuarial science or economics can increase the chance of securing a senior management role.

Additionally, you’ll usually also need 2 or 3 A levels, or equivalent, including maths.

Here are some do’s and don’ts for an actuary professional CV:

Yes! A cover letter is an important addition to your application. This is an opportunity to explain your skills and experience in further detail. If you don’t have previous actuary experience, this is a good chance to explain why your skills and industry knowledge make you the ideal candidate for the role.

You can still write a perfect actuary CV without a lot of experience. Focus on transferable skills and highlight your education. You can also list other activities (internships, volunteer work) that utilise skills you need for actuary work. This can prove to the hiring manager or recruiter that you have the right knowledge and soft skills to fulfil the role.

To create a successful CV, you’ll need to customise it for each application. Carefully read the job description and highlight key skills the recruiter is looking for. Then include these skills in your CV. This makes your CV stand out and portrays you as the perfect candidate for the role!

We personalize your experience.

We use cookies in our website to ensure we give you the best experience, get to know our users and deliver better marketing. For this purpose, we may share the information collected with third parties. By clicking “Allow cookies” you give us your consent to use all cookies. If you prefer to manage your cookies click on the “Manage cookies” link below.